1. My salaries income includes bonus, allowance, and commission. How should I report such income?

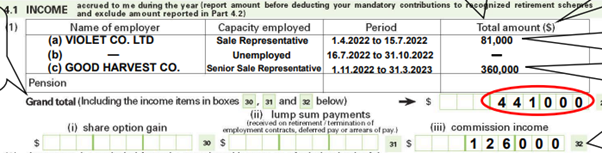

You should add up all of the above and fill in Part 4.1 of your Tax Return – Individuals by entering the total amount in item (1). You should also fill in Box no. 29, which is the grand total of all income from all of your employers (see example below). Besides, you also should report the total amount of commission income in Box no. 32.

Example

| Details of income from VIOLET CO. LTD | $ | Total ($) | |

| Salary | 70,000 | ||

| Commission | 6,000 | ||

| Bonus | 5,000 | 81,000 | |

| Details of income from GOOD HARVEST CO. | |||

| Salary | 235,000 | ||

| Commission | 120,000 | ||

| Cash allowance | 5,000 | 360,000 | |

| 441,000 | |||

How to complete/fill in the data on your Tax Return –Individuals

Print

Print Email

Email